Fidelity Investments

Fidelity Investments provides administrative services for Montefiore's retirement plans. Fidelity’s website – NetBenefits® – provides the insight, guidance, and transactional capabilities to make retirement more manageable.

Click here to schedule your virtual one-on-one consultation

Set Up Your Fidelity Account

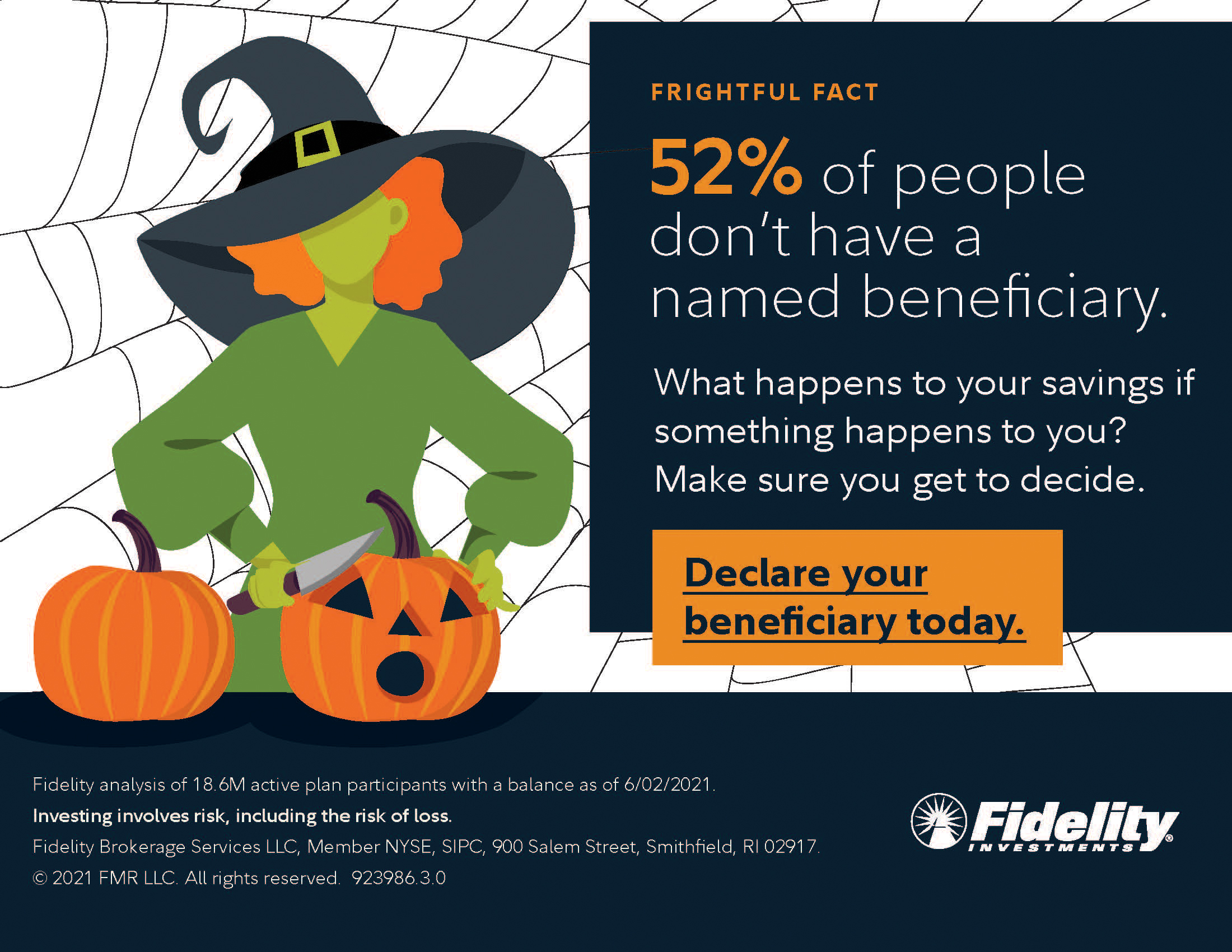

Log on to Fidelity NetBenefits®. Click “Register” at the top of the page and follow the step-by-step instructions to set up your account, account access information and set email preferences. Once your account is set up, be sure to designate your beneficiaries, click “Profile” and then “Beneficiaries”.

You may also contact the Fidelity Retirement Service Center at 800.343.0860 to set up your account access and request a beneficiary form.

NetBenefits Home Page

Your NetBenefits home page makes it easy to:

- Review your account balances and portfolio details

- Request changes to your account

- Review your investment options

- Research investment performance

- Request a loan or withdrawal

- Access helpful tips and tools

Annual Increase Program

Help boost your contribution amount automatically: The Annual Increase Program allows you to increase your retirement savings plan contributions automatically each year. It’s an easy way to help keep yourself on track as you get closer to retirement. Choose the amount and date for your annual increase, and the rest is automatic. Each year on the designated date, your contributions will increase by the amount you elected. For more information visit www.netbenefits.com or call 800.343.0860.

Education Resources & Tools

Planning & Guidance Center

Model and plan your retirement strategy with interactive tools and calculators.

- Complete the Investor Profile Questionnaire for a comprehensive asset mix review. Learn about your risk tolerance and asset allocation.

- Model different savings scenarios using the Take Home Pay Calculator or Contribution Calculator

- See how changes in your savings habits could change your estimated monthly retirement income with Income Simulator

- Try hypothetical scenarios using the Roth Modeler to see differences between pre-tax and Roth after-tax deferrals

- Use the Fidelity Income Strategy Evaluator® to help build a portfolio for your retirement income.

Library

Search the Library for a variety of multi-media financial resources

- Watch a video about managing your debt

- Read an article to learn more about stocks, bonds and short-term investments

- Listen to a podcast about retirement planning

Life Events

Refer to Life Events to help with timely financial and benefits decisions.

- New Hire Checklist

- Savings and Spending Checkup

- Retirement Checklist